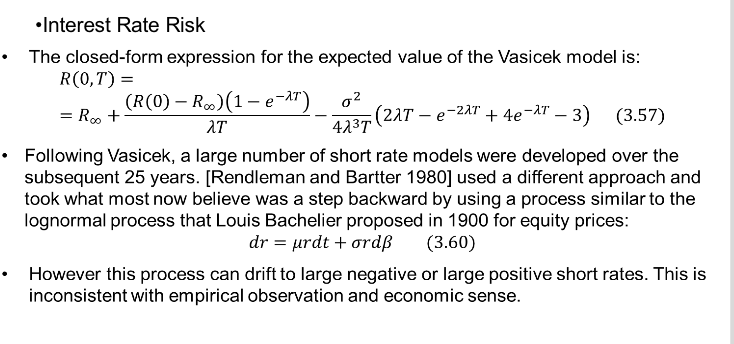

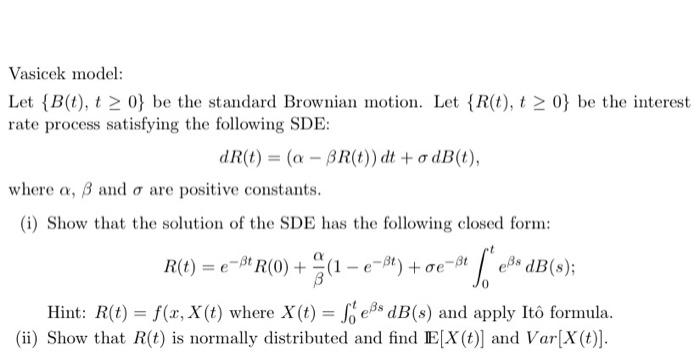

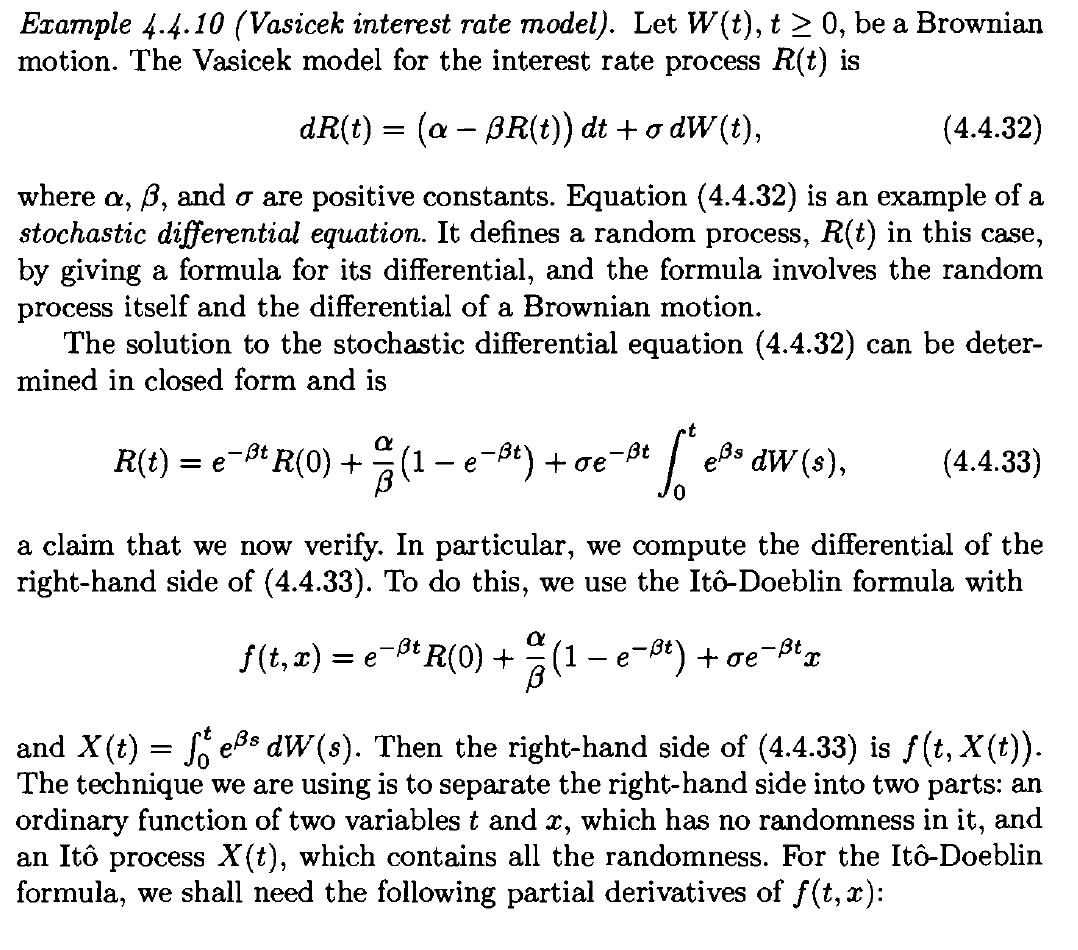

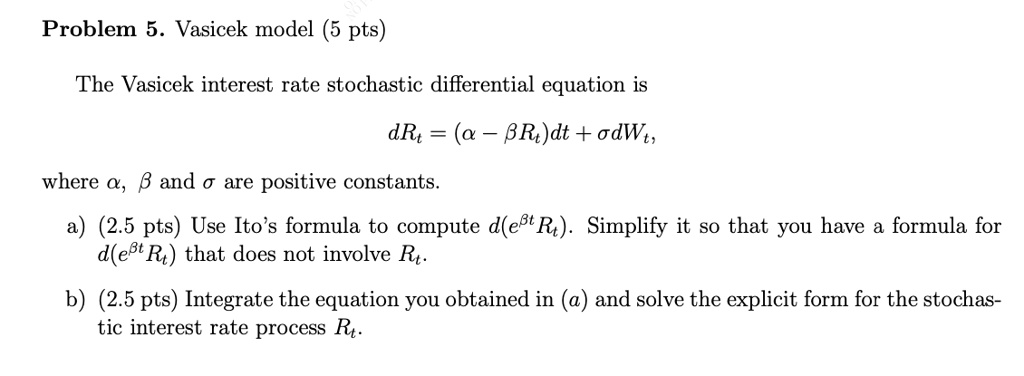

SOLVED: Problem 5. Vasicek model 5 pts) The Vasicek interest rate stochastic differential equation is dRt (a BR)dt + odWt; where , and are positive constants (2.5 pts) Use Ito's formula to

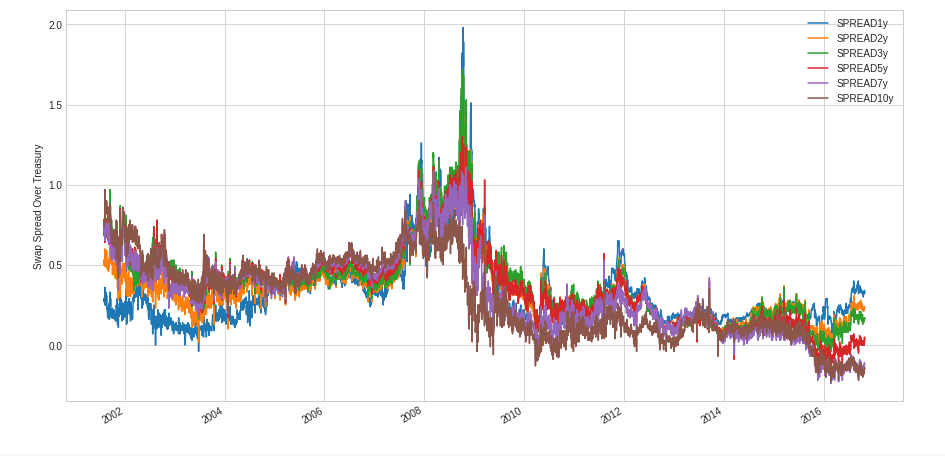

Mathematics | Free Full-Text | A Closed-Form Pricing Formula for Log-Return Variance Swaps under Stochastic Volatility and Stochastic Interest Rate

Finding B(t) in the Vasicek model relating to the bond equation, more specifcally from the initial condition - Quantitative Finance Stack Exchange